Before the COVID-19 pandemic, plastic supply chains across the globe in various sectors, were using models designed to achieve steady output of production at factories, semi-optimal inventories in distribution, and provide just in time delivery to the end user. The reason: raw materials were, for the most part, readily available. There were disruptions, such as natural and manmade disasters. A couple examples include flooding from a hurricane in one plastic resin factory, and hackers hijacking the software of a large plastics manufacturer. These weren’t the rule back then, these were exceptions to the rule.

During the years of the pandemic, as vaccines became available, and governments opened up, demand shot up. Simultaneously, with the increase in demand, the plastics resin production was dashed due to natural disaster in the gulf coast, a freak winter storm froze the pipes in nearly every facility that produced 40% of the global plastics resin supply. This led to unprecedented purchasing and inventory practices all up and down the plastics supply chain. What was considered normal before COVID-19, was a thing of the past. For 2 years, it was a frenzy of activity. And then, it stopped. 2023 saw a huge slowdown. Manufacturing entered into a recession-like downturn. Factories, distributors, fabricators, and end users were caught with exorbitant amounts of inventories. Plastics distribution was in a lull. Materials weren’t moving because further down the chain plastic fabricators weren’t getting orders for plastic parts; OEMs and end users had no need for the materials, as they were stocked up on their products.

Today, as we navigate the economic uncertainty, rocky labor market, and manufacturing challenges post-pandemic, plastics distribution is still playing a critical role, as the connection between manufacturers of raw plastic materials, to the consumer.

G10 Plastic cut-to-size pieces seen below

- Communication is Key: Working with your distributor’s representative, conveying your needs for inventory, pricing, and specific certification requirements, is critical to enhancing the working relationship between distributor and customer. Inventory plans, pricing concessions, and certifications can usually be accommodated with the proper level of communication and planning. Working together is the best path forward.

- Value-Add services. Most distributors offer additional services such as cutting, routing, machining, forming, drilling, welding, tapping, etc. If communicated in the early stages of quoting, these services can be capitalized to assist you in reducing lead time. Whether it’s providing a cut-to-size blank, a semi-finished part, CNC Router cut circle, planed surface, or formed acrylic parts; these value-add services can help minimize your labor time, machine time, and lead times. This is particularly helpful with a rocky labor market and shortage of machine operators and programmers.

Delrin Plastic sheet featured below

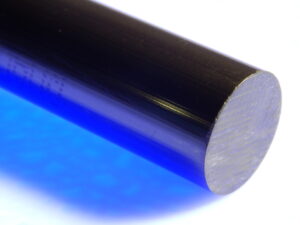

Torlon Rod pictured above

Tygon tubing pictured above

In summary, as the plastics supply chain continues to navigate the uneasy economic pressures, inflation/deflation concerns, and lower demand, it is just as critical to rely on plastics distribution to continue providing the materials and value-add services to meet the needs of the customer: you! Inventory plans, delivery schedules, certifications, pricing concerns, additional services that add value to the end product, can be leveraged with great communication between customer and distributor. We can all move forward together, and build upon success now, and in the future.